Trusted by teams everywhere

Why Everlance?

Stress-free mileage tracking

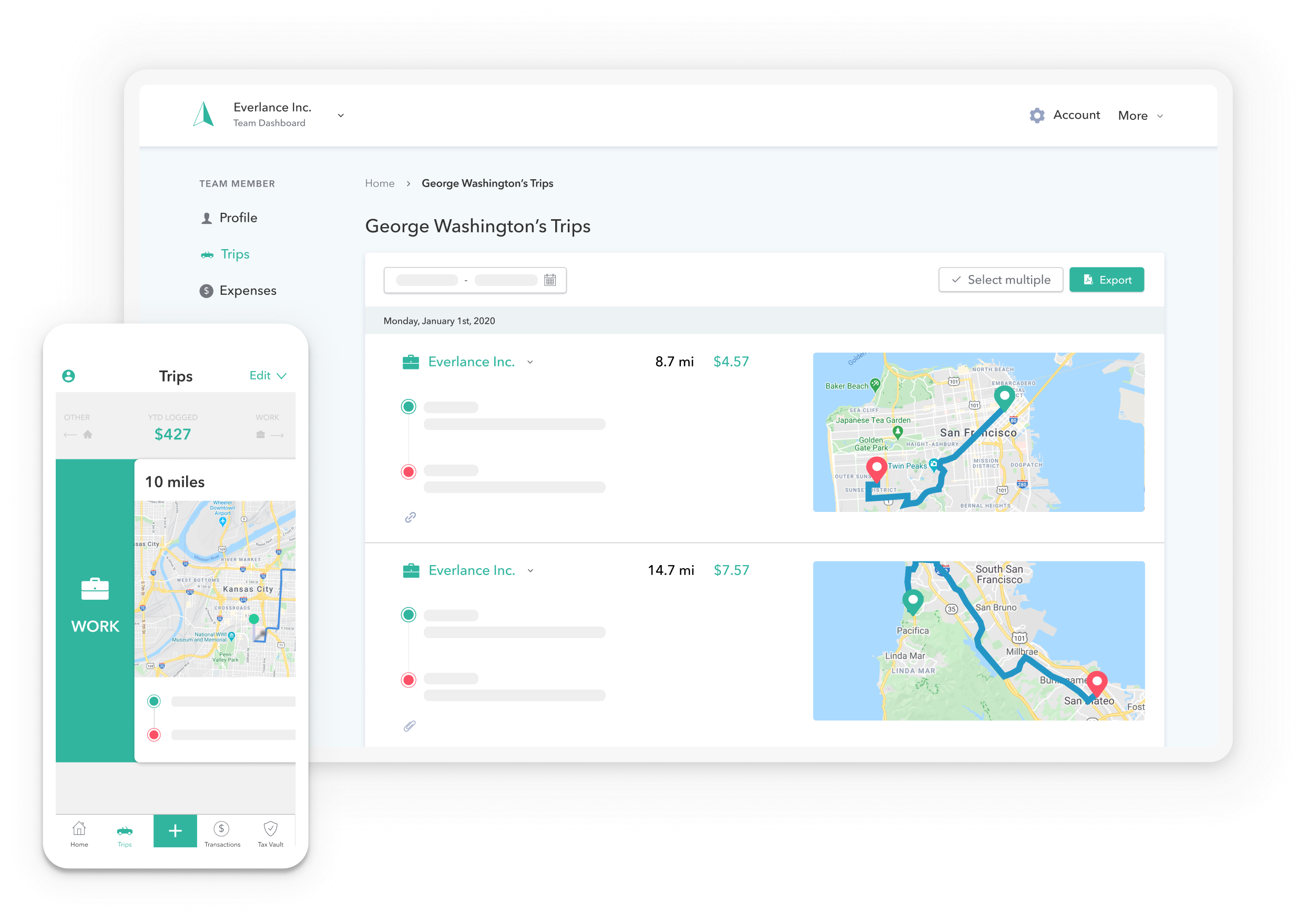

Your team's trips are automatically and accurately tracked with our #1-rated app, so no one has to waste time capturing miles or chasing down employee logs

Save money and stay on top of program spend

FAVR avoids over-reimbursing high mileage drivers and employees in lower cost areas, and reduces your liability risk.

Everlance partners with you to develop and manage a vehicle reimbursement program that fairly compensates employees for the costs of driving their personal vehicle and aligns to your monthly spend goals.

Efficiently administer your FAVR program

With Everlance, you're freed from the burden of vehicle and reimbursement management. Gain back time with our experts taking care of every step and keeping your drivers happy:

- Initial fixed and variable rate design

- Compliance management

- License and insurance validation

- Monthly variable rate adjustments

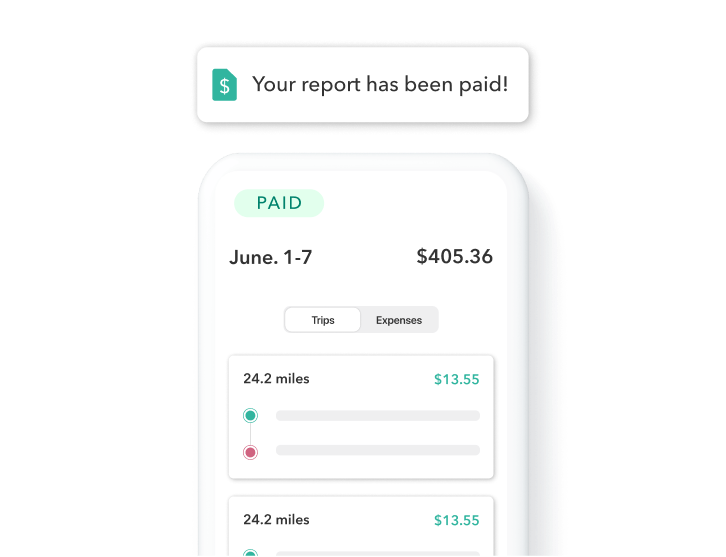

- Reimbursement payments to employees

- Email, phone and chat support

Ensure a smooth transition for your team

Whether you currently provide company vehicles, give a car allowance, reimburse with cents-per-mile or are using an alternative FAVR provider, our implementation and onboarding process makes it easy to move to Everlance.

A named Customer Success Manager helps align the program to your unique processes, communicates to drivers and managers, conducts training and proactively responds to your questions.

Get in touch

The Everlance Difference

The Everlance Difference

![]() Automatic & reliable GPS trip tracking

Automatic & reliable GPS trip tracking

![]()

Smart auto-classification with work hours, favorite trips and more

![]() Dynamically updated manager dashboard with starting & ending times and route map for every trip

Dynamically updated manager dashboard with starting & ending times and route map for every trip

![]() Integrated expense management

Integrated expense management

![]()

Customizable report approval flows

![]() Multiple options for reporting and data exports

Multiple options for reporting and data exports

![]()

Admin controls to manage team structure, set favorite places, customize expense codes, etc.

![]() Named Customer Success Manager

Named Customer Success Manager

Frequently Asked Questions

What is a fixed and variable rate (FAVR) vehicle program?

A FAVR vehicle program reimburses employees for the business use of their personal vehicle through a combination of a fixed monthly allowance and a variable payment that is based on the number of actual miles they drive and a customized per mile reimbursement rate.

How do FAVR programs differ from Cents-per-Mile (CPM) programs?

A Cents-per-Mile (CPM) program uses a set mileage rate, such as the IRS standard rate, to reimburse employees for every mile they drive their personal vehicle for work purposes. It reimburses employees at the same rate per mile, regardless of how many miles they drive, where they operate the vehicle, or the type of vehicle they might drive to perform business tasks. The rate typically does not change through the course of a year.

A FAVR program is a more sophisticated and fair mileage reimbursement program. Everlance’s FAVR vehicle program takes into account an employee’s fixed costs of vehicle ownership (depreciation, taxes, insurance, license & registration, etc.) and variable costs of vehicle operation (oil & gas, maintenance, tire wear, etc.) for their location and vehicle type to determine their fixed and variable reimbursement rates. The variable rate may also change month-to-month to keep up with changing fuel prices.

Is Everlance’s FAVR program tax free?

Yes, when designed according to guidelines set by the IRS, a compliant FAVR program allows tax-free reimbursements to employees for the cost of owning and operating a personal vehicle for work purposes.

In this sense, FAVR is similar to CPM in that both programs are tax-free methods for reimbursing employees’ business expenses, according to the IRS guidelines.

How is a FAVR allowance different from a monthly stipend?

While a fixed driving stipend or car allowance is a simple and straightforward program to offer employees, it is considered a fringe benefit that is taxable. This tax burden applies to both employees (income taxes) as well as their employer (payroll taxes). A compliant FAVR program that is properly implemented allows tax-free mileage reimbursements to employees.

In addition to this tax advantage, FAVR programs are generally more fair to employees than monthly stipends. A FAVR program accounts for each employee’s actual vehicle costs and the amount a particular employee may or may not drive for work.

Who is eligible for a FAVR program?

Everlance will work with you to develop and implement a compliant FAVR program that achieves your organization’s budgetary objectives. Certain IRS requirements, such as a minimum of 5 employees each driving more than 5,000 business miles per year, will determine whether your organization is eligible for a FAVR program. Please reach out if you would like help deciding if FAVR vehicle reimbursements are right for your team.